The job market for C++ quantitative developers is experiencing a major surge. Driven by the relentless demand for low-latency execution, many hedge funds and trading firms are ramping up hiring. C++ remains the gold standard for performance-critical systems in finance — and its dominance is growing.

Top firms like Citadel, Jane Street, and Jump Trading are offering eye-watering compensation packages to attract talent.

In London, New York, and Singapore, six-figure base salaries are now entry-level — with total comp often exceeding $500k.

Real-time risk, high-frequency trading, and exotic derivatives desks all need C++ expertise.

The rise of data-driven modeling has only reinforced the need for tight integration between quant models and execution engines.

Firms want devs who can code, optimize, and understand the math — and C++ sits at that intersection.

With competition heating up, even junior roles now demand systems-level thinking and modern C++ fluency.

For quants and devs alike, now is a golden moment to ride the C++ finance wave.

1. Some Data about Salaries

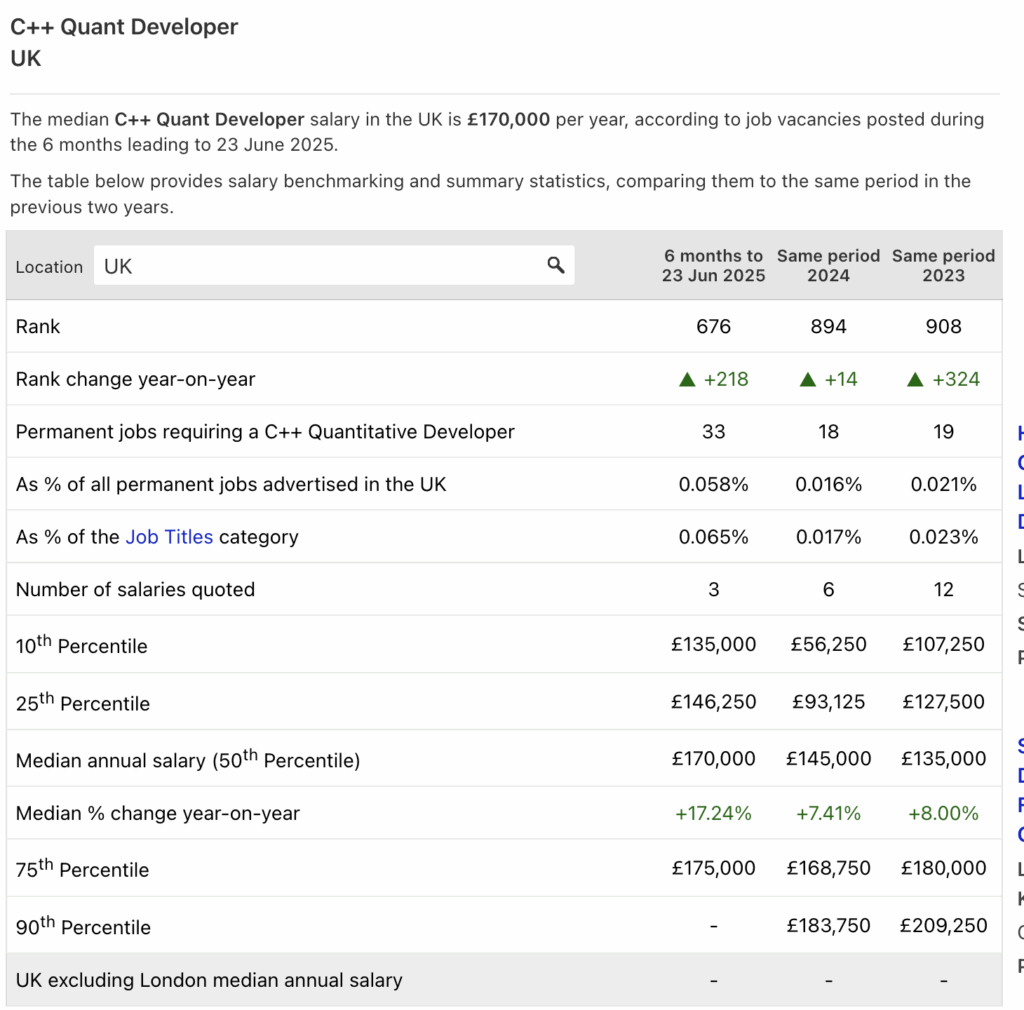

The demand for C++ Quant Developers in the UK has exploded — and salaries reflect it. The median salary has jumped to £170,000, up 17.24% year-on-year, continuing a multi-year upward trend. Even more striking, the 10th percentile salary has more than doubled since 2024, rising from £56,250 to £135,000, suggesting that entry-level roles are commanding mid-career paychecks.

The number of permanent roles has also nearly doubled in a year, with 33 positions advertised versus just 18 the year prior. C++ quant roles now represent 0.058% of all UK job ads, a 3.6x increase in relative share — highlighting how niche, high-impact, and in-demand this skillset has become.

Whether you’re a seasoned systems programmer or a mathematically-minded developer eyeing the finance sector, the numbers don’t lie: it’s a C++ quant boom.

2. The Trend is Volatile but Clearly Goes Up

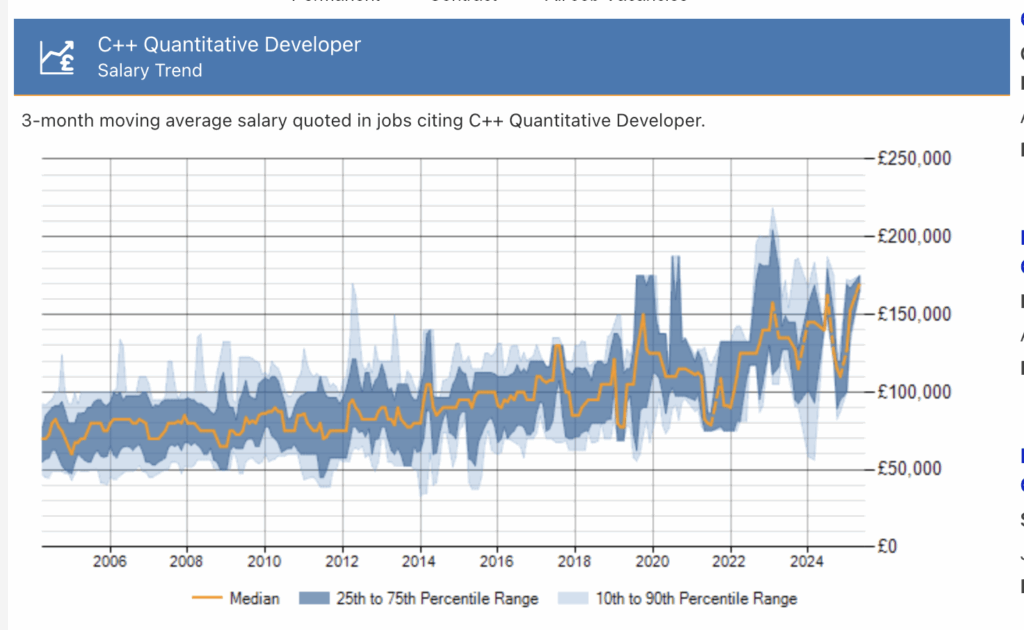

This 20-year salary trend graph shows a clear and accelerating rise in compensation for C++ Quantitative Developers in the UK. After a decade of relative stability from 2005 to 2015, salaries began a marked upward shift around 2018, aligning with the growing demand for low-latency systems and tighter model-to-execution integration. Since 2020, volatility has increased — but so has the upside. The median salary line (orange) now sits firmly above £150,000, with the top 10% breaching the £200,000+ mark. Even the 25th percentile has climbed significantly, pointing to strong tailwinds across all seniority levels. As of mid-2025, the trend is steeply upward — a reflection of how C++ has reasserted itself as a core technology in quant finance.

3. The Tools, Skills, Exposure and Libraries Required

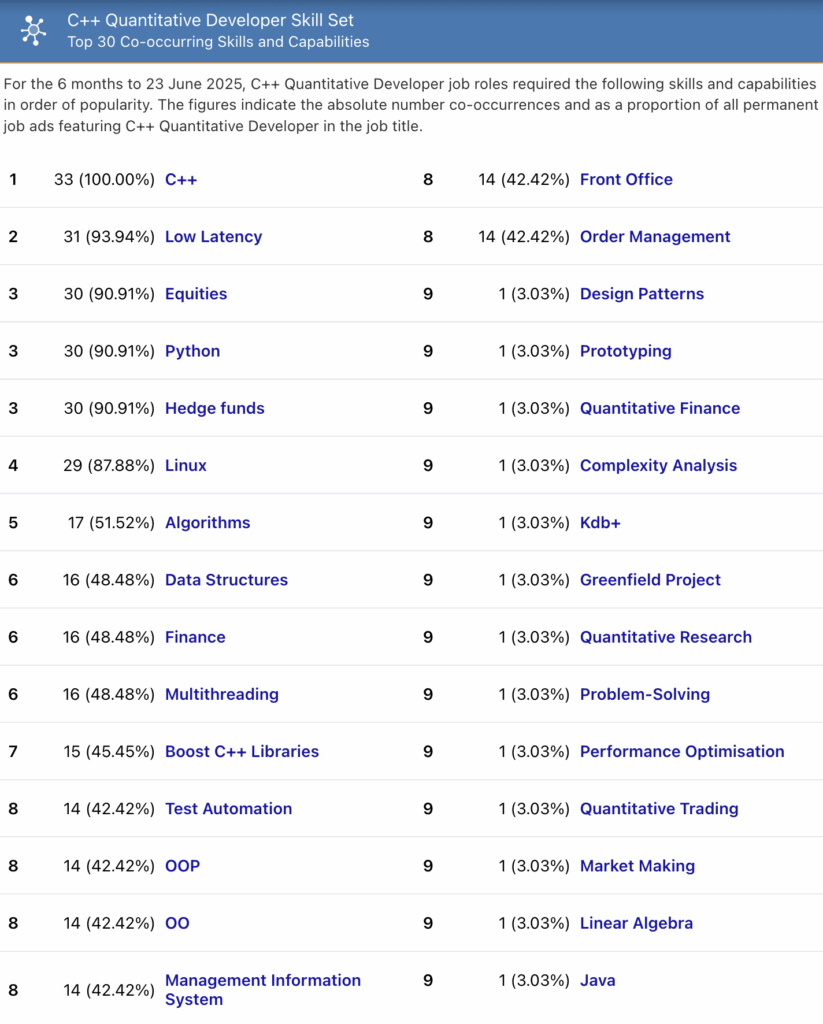

The C++ Quant Developer role is no longer just about knowing C++. According to data from the six months leading up to June 2025, Low Latency (93.94%), Equities, and Hedge Funds appear alongside C++ in nearly all job ads, signaling a strong demand for developers who understand real-time execution environments in capital markets.

Interestingly, Python (90.91%) appears just as frequently — reinforcing the industry’s shift toward hybrid devs who can optimize in C++ and prototype in Python.

Skills like Linux, Multithreading, Algorithms, and Data Structures remain core, while mentions of Boost, Test Automation, and Order Management show that system reliability and front-office tooling are just as valued as raw performance.

Whether it’s Quantitative Trading, Market Making, or Greenfield Projects, this skill map clearly shows that modern quant devs must span systems engineering, financial markets, and rapid prototyping — a rare and highly-paid blend.

4. Conclusion

The data is unambiguous: C++ Quantitative Developers are among the most sought-after professionals in finance today. Salaries are surging, with median comp hitting £170,000, and top roles exceeding £200,000+. Even the lowest percentiles are rising fast — entry-level is no longer “junior” in pay. Demand has more than doubled year-on-year, with job postings climbing steadily. C++ sits at the core of high-frequency trading, real-time risk, and complex derivatives pricing.

But employers aren’t just hiring C++ coders — they want versatile technologists. Fluency in Python, Linux, Multithreading, and Low Latency architecture is essential. Firms want devs who can design systems, optimize them, and understand market dynamics. This is no longer a back-office role — the Front Office is calling, and it pays.

Whether you’re a quant with systems chops or a dev learning finance, now is the time to strike. The most competitive candidates understand both algorithms and alpha. They build fast, test fast, and deploy into production with confidence. The C++ quant role is evolving — it’s becoming broader, better-paid, and more central to business.

This is not a bubble. It’s a structural shift. As market infrastructure becomes more automated and data-hungry, firms will invest heavily in top-tier engineering. That means a long runway for anyone investing in the right skills now.

If you’ve been on the fence about switching into finance — consider this your signal. And if you’re already here: it’s time to double down on your edge.