When I started my journey in quantitative development, I didn’t have a clear roadmap: just curiosity and a love for both code and markets. I was a Python machine learning engineer for years before realizing that the intersection of finance, mathematics, and software engineering was where my mind truly thrived. Over time, I transitioned from real-time ML systems to building pricing models, working with risk engines, and optimizing massive data pipelines: the kind of problems that sit at the heart of quantitative finance. So, how to become a quantitative developer?

If you’re reading this, you might be standing at a similar crossroads. Maybe you’re a developer who’s intrigued by trading systems and quantitative models. Maybe you’re a mathematician who wants to turn theory into production code. Or maybe, like me, you simply want to understand how raw market data transforms into the numbers driving billion-dollar decisions.

Becoming a quantitative developer is about learning how to think like both a scientist and an engineer, balancing mathematical rigor with system design and performance awareness. In this article, I’ll break down what it takes to enter the field, what quantitative skills truly matter, and how to build the kind of mindset that thrives in quant environments from investment banks to hedge funds and prop shops.

1. The Classic Path: Study Computer Science and Finance

The traditional route into quantitative development starts with a strong foundation in computer science, mathematics, and finance. Many professionals follow this academic path through degrees in computer science or applied mathematics, often complemented by a master’s in financial engineering or quantitative finance from institutions such as Imperial College London, ETH Zürich, Carnegie Mellon University, or Université Paris-Saclay. How to become a quantitative developer? Generally speaking, when you’re playing that path, try to shoot a university in that group:

Mathematics matter, so choose your major carefully. I’m biased because it’s what I studied but without it: you will plateau. Why? Watch this:

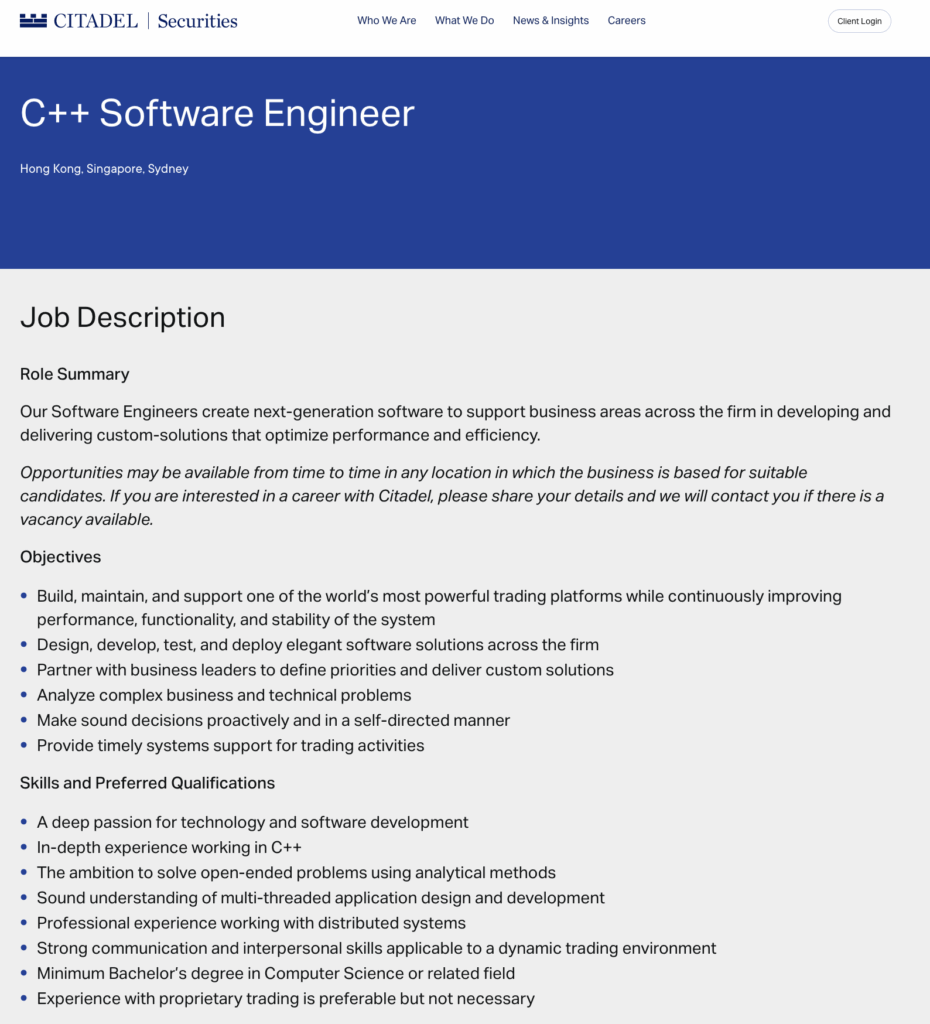

Take Max, for example — a computer science graduate from ETH who later completed a Master’s in Financial Engineering at Imperial. During his studies, he learned to build valuation models in Python, write C++ for high-performance simulations, and understand the pricing mechanics of derivatives and bonds. By the time he graduated, he could not only optimize a sorting algorithm but also explain what a convexity adjustment meant in a swap curve — and that combination is gold in the quant world.

2. The Pirate Path: Get Any Job and Move Towards Quantitative Finance

But you can do it differently. Not like Max.

Maybe you didn’t go to Imperial or ETH. Maybe your degree wasn’t in quantitative finance — or you didn’t even study finance at all. That’s fine. The truth is, a lot of successful quantitative developers didn’t follow the “textbook” path. They hacked their way into it: from software engineering, data science, or even DevOps.

I call this the Pirate Path.

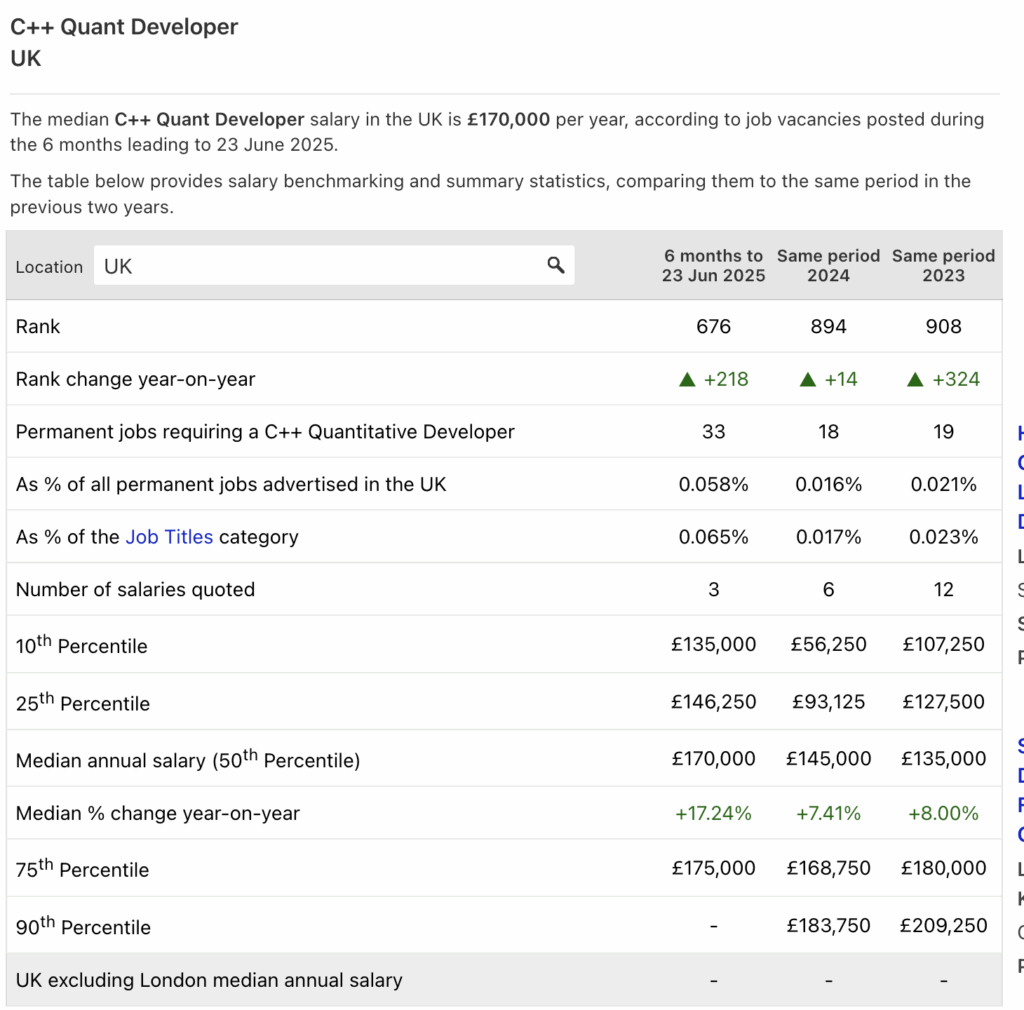

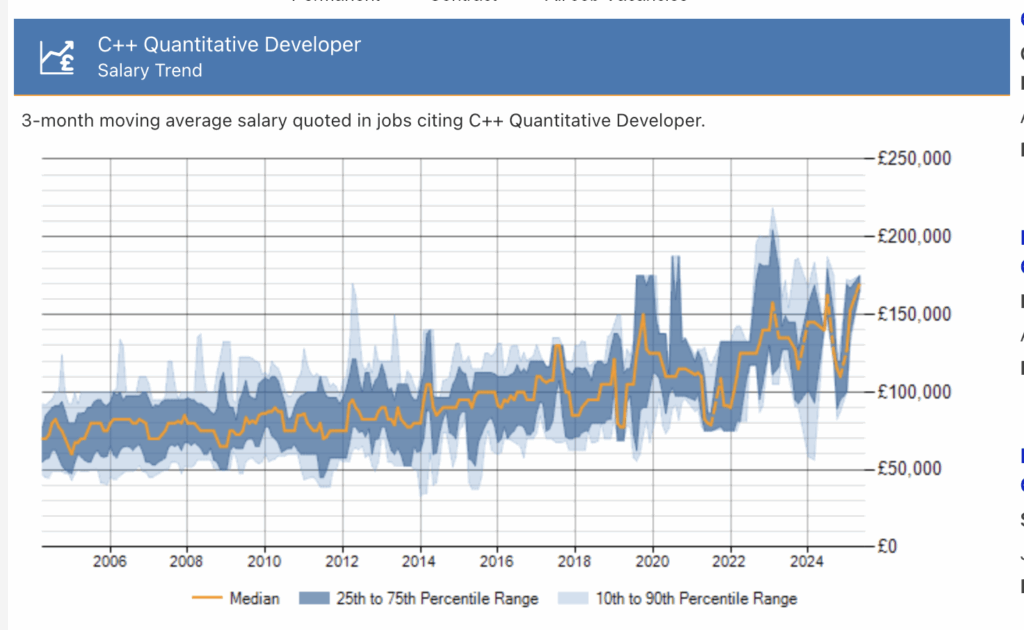

You start by getting any strong engineering job: one that forces you to write production-grade code, ship systems, and solve real-world latency or data problems. You learn to build, debug, and scale things that matter. Then, little by little, you sail toward finance: you read about markets, build small analytics projects on the side, or start automating something related to trading data.

You will need to learn little by little about every domain linked to quant engineering and it’s best if you it in each job you move to:

This requires to move job strategically to collect skillsets like mushrooms in Mario. Build the map and check the boxes.

Little by little, apply to more and more of those companies:

3. The Self-Made Path: Produce Content About it and Get Noticed

Then there’s the third way: the one that didn’t really exist twenty years ago but is now reshaping how people break into the quant world. The Self-Made Path.

This is the route of the builder-creator hybrid. You don’t just learn, you document what you learn.

You share your experiments, your insights, and your projects with the world. Write threads, blog posts, tutorials, or publish open-source tools. The more you share, the more you attract people who think like you… and sooner or later, that visibility opens real doors.

That’s how I ended up connecting with many in the quant and fintech world: by writing and publishing regularly. Whether it was explaining pricing models, exploring real-time ML systems, or diving into C++ performance topics, I was simply trying to make sense of my own work in public. But what started as writing for myself ended up building credibility, network, and opportunity: the things that often matter more than a title or diploma.

The Self-Made Path rewards curiosity, consistency, and clarity. If you can explain complex financial or technical concepts in a way that others understand, you’re already thinking like a quant developer because that’s exactly what we do: take something abstract and make it precise, testable, and real.

So if you’re just getting started, don’t wait for permission. Start writing. Record videos. Open-source your tools. People will notice. And when they do, the line between student and quant developer starts to blur very quickly.

Conclusion

So, how to become a quantitative developer? There isn’t just one way to become a quantitative developer, there are many. Max took the classic route through top universities, guided by structure and theory. The Pirate took detours, learning from production fires, late-night debugging, and messy real-world systems. The Self-Made builder created his own spotlight by sharing what he learned in public.

Each path has its price and its reward.

The Classic Path gives you clarity.

The Pirate Path gives you grit.

The Self-Made Path gives you reach.

What matters most isn’t where you start, but how far you’re willing to keep learning once you’re in motion.

Finance evolves fast. So do programming languages, architectures, and datasets.

The best quantitative developers stay curious, adaptable, and humble, engineers of both code and understanding.

Whether you’re optimizing a pricing engine in C++, experimenting with yield curve fitting, or explaining your latest discovery on a blog, you’re doing the same thing: turning complexity into clarity.

So pick your path. Build. Break things. Learn.

And remember: in this world, curiosity compounds faster than capital.