Founded by Ken Griffin in 1990, Citadel has evolved into a global powerhouse, consistently delivering top-tier returns across its multi-strategy portfolios. But behind its alpha-generating engine lies an often underappreciated force: the C++ quantitative developers who architect the low-latency systems, model risk in real time, and turn market chaos into structured opportunity.

1. The Rise of Citadel

Founded in 1990 by Ken Griffin with just over $4 million in capital, Citadel has grown into one of the most successful hedge funds in history. Headquartered in Chicago, it now manages over $60 billion in assets and operates across the globe, including offices in New York, London, Hong Kong, and beyond.

Citadel is not a single-strategy fund—it’s a multi-strategy powerhouse, deploying capital across equities, fixed income, commodities, credit, and quantitative strategies. This diversification, paired with robust risk management, has made the firm highly resilient through market cycles.

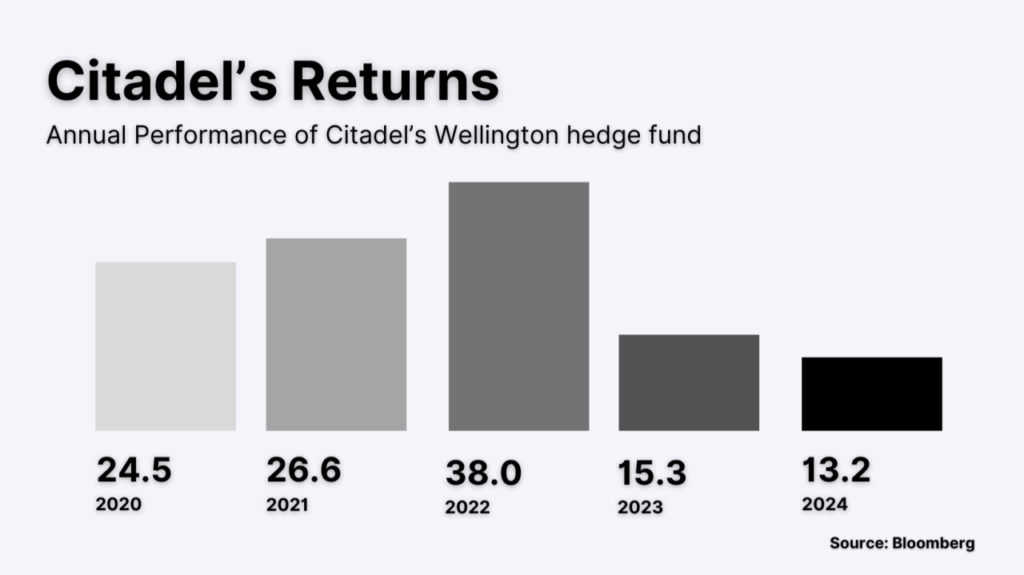

What sets Citadel apart isn’t just its performance—though returns like 38% in 2022 certainly command attention—but its deep integration of technology and talent. The firm runs on infrastructure built for speed, scale, and precision, and this is where quantitative developers come in.

Its flagship Wellington fund has outperformed many rivals, even in turbulent years. Citadel’s ability to consistently extract alpha is often attributed to its collaborative model, where engineers, researchers, and portfolio managers work shoulder-to-shoulder.

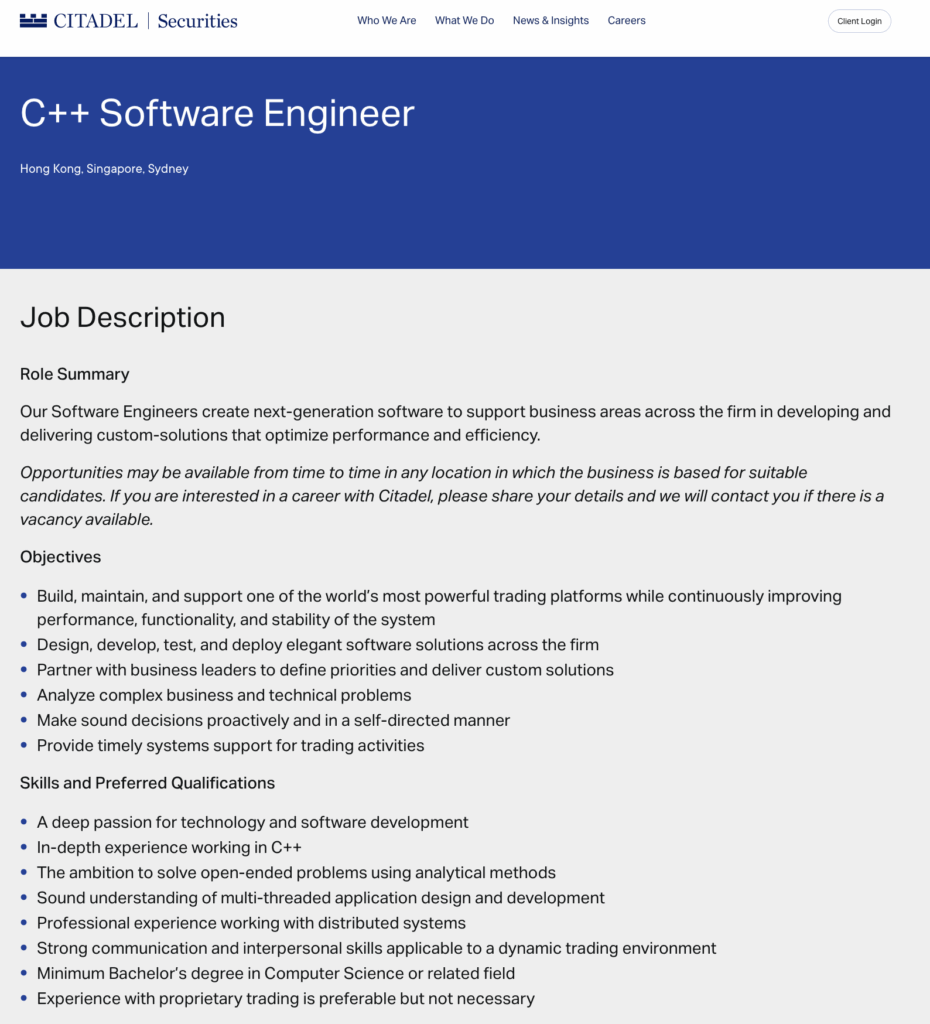

The firm’s reputation as a developer-first hedge fund has drawn some of the world’s top C++ talent. At Citadel, engineering is not support—it’s strategy.

With a culture that values innovation, ruthless execution, and data-driven decision making, Citadel has become more than a hedge fund—it’s a financial technology juggernaut.

2. C++ at Citadel

Citadel operates at nanosecond precision. That level of performance demands fine-grained control over memory, concurrency, and CPU cache: all things C++ excels at. Unlike higher-level languages, C++ lets developers write code that talks directly to the hardware, eliminating unnecessary overhead.

The firm’s systems are responsible for processing millions of market messages per second, reacting to market events in real time, and executing trades across global venues. This wouldn’t be possible without the deterministic behavior and performance characteristics of C++.

But Citadel’s use of C++ isn’t limited to execution systems. Quant researchers rely on C++ libraries to backtest strategies, model derivatives, and run complex simulations at scale. Its computational efficiency makes it ideal for workloads that can’t afford latency or garbage collection pauses.

Citadel also invests heavily in modern C++, adopting features from C++17 and C++20 where they offer measurable gains in safety, readability, or performance. Engineers are encouraged to write clean, maintainable code—but never at the cost of latency.

Citadel’s tech culture rewards those who can profile, benchmark, and optimize. The best C++ quants here don’t just code—they engineer alpha.

3. Salaries at Citadel

- Citadel Securities Quantitative Developer / Research Engineer roles have a base salary range of $250,000–$350,000, with discretionary incentive bonuses on top teamblind.com+12citadelsecurities.com+12teamblind.com+12.

- Central Risk Services Quant Dev positions offer a lower base range of $150,000–$300,000, plus discretionary bonuses and full benefits investopedia.com+3citadel.com+3glassdoor.com+3teamblind.com+1fnlondon.com+1.

- According to Levels.fyi, software engineering roles (which often include quant roles) at Citadel report total compensation between $369K (L1) up to $586K (L5), with a U.S. median of $435K citadelsecurities.com+11levels.fyi+11indeed.com+11teamblind.com+1indeed.com+1.

- On Glassdoor/Indeed, reported base pay averages range widely:

- Glassdoor reports ~$224K/year average for Quant Dev teamblind.comreddit.com+7glassdoor.com+7teamblind.com+7.

- Indeed reports around $170K/year, with ranges from $85K–$257K teamblind.com+4indeed.com+4glassdoor.com+4teamblind.com+5teamblind.com+5levels.fyi+5.

- Reddit/industry anecdotes suggest: “Quant Developers: $300k–1M”

Contributions near alpha can push compensation toward the high end fnlondon.comreddit.com+5reddit.com+5levels.fyi+5. - QuantNet survey indicates for top-tier quant roles (2–5 years of experience):

- First-year total comp spans $350K–$625K (base $150K–$300K + sign-on $50K–$200K + bonus $75K–$150K) fnlondon.com+11quantnet.com+11reddit.com+11.

- By 5 years, total comp may reach $800K–$1.2M with solid performance.

- TeamBlind insights highlight that senior quant devs at Citadel can expect $650K–$900K total compensation, especially for C++ specialists quantnet.com+1reddit.com+1reddit.com+11teamblind.com+11teamblind.com+11efinancialcareers.com+3businessinsider.com+3reddit.com+3.

Summary Snapshot

| Role / Seniority | Base Salary | Total Compensation |

|---|---|---|

| Entry Quant/Research Engineer | $150K–$300K | $250K–$400K+ |

| Junior SWE / Quant at Citadel Securities | $250K–$350K | $350K–$600K (Levels.fyi data) |

| U.S. Median SWE @ Citadel (all levels) | — | $435K |

| Mid-level (2–5 yrs experience) | $150K–$300K base | $350K–$625K |

| Senior (5+ yrs, high-performers) | N/A | $800K–$1.2M+ |

| Top-tier C++ Quant Dev (High perf, senior) | — | $650K–$900K (and above) |

✅ Key Takeaways

- Base ranges: Typically $150K–$300K depending on team and experience.

- Total compensation: Often $350K–$600K early in career, with senior/high-impact quants exceeding $800K and potentially hitting $1M+.

- Bonuses & incentives: Discretionary, performance-based, and can include multi-year vesting or trading revenue share.

- C++ expertise is highly prized—especially for roles touching low-latency systems—often commanding top-end packages.

4. Conclusion on Citadel

Citadel is a technology-driven trading powerhouse where engineering excellence meets financial strategy. For C++ developers, it’s a rare environment where your code directly moves markets, influences multi-billion-dollar portfolios, and demands world-class technical execution.

Its use of cutting-edge C++, relentless focus on performance, and collaborative culture put it at the frontier of quantitative finance. From optimizing nanosecond latency to building scalable real-time infrastructure, developers at Citadel solve problems that few other places even attempt.

Compensation reflects this intensity: total packages rival top tech firms and reward measurable impact. But beyond the pay, Citadel offers a sense of ownership and precision that appeals to the most driven minds in systems programming and quantitative research.

For those who thrive under pressure, care deeply about system-level performance, and want to work alongside the best in finance and engineering: Citadel is the summit. And C++ is one of the best languages that gets you there.