Geopolitical Tensions and Market Volatility: Key Themes for Finance Professionals

In today’s complex global landscape, finance professionals must stay attuned to the interplay between geopolitics and market dynamics. As discussed in the “Geopolitics Needs Policy to Move Risk: 3-Minute MLIV” video, factors such as the ongoing situation in Venezuela and the potential impact of Iran protests require careful analysis and strategic consideration.

Additionally, the “US To Control Venezuelan Oil ‘Indefinitely’; Iran Protests | Horizons Middle East & Africa 1/8/2026” video sheds light on the U.S. government’s plans to exert control over Venezuela’s oil exports, a development that could have significant implications for global energy markets.

Furthermore, the “ICE Minneapolis Shooting & Trump Demands More Defense Spending | Daybreak Europe 1/8/2026” video highlights the potential for geopolitical events, such as the ICE shooting in Minneapolis, to influence market sentiment and volatility.

To round out the discussion, the “Fun Quant Interview Question #quantinterviews” video presents a thought-provoking quantitative challenge that finance professionals may encounter in their career development.

🎥 Geopolitics Needs Policy to Move Risk: 3-Minute MLIV (Bloomberg)

The video’s thoughtful examination of the interplay between geopolitics and economic policy offers valuable insights for analysts and investors navigating today’s complex market landscape. By breaking down key themes such as the impact of Trump policy changes, the influence of AI and tech stocks on inflation, and China’s regulatory decisions, the panel provides a nuanced perspective on the multifaceted factors shaping global markets. As the world grapples with heightened geopolitical tensions, this insightful discussion underscores the critical importance of tailored policy responses to effectively manage and mitigate emerging risks.

🎥 US To Control Venezuelan Oil ‘Indefinitely’; Iran Protests | Horizons Middle East & Africa 1/8/2026 (Bloomberg)

The U.S. plans to indefinitely control future sales of Venezuelan oil, with President Donald Trump stating that the country will use the revenue only to purchase U.S.-made goods. Additionally, Bloomberg News has learned that Russia targeted South African video gamers as part of a recruitment drive for its war in Ukraine. In Iran, the president has ordered security forces not to target peaceful protesters, while Saudi Arabia’s Tadawul All Share Index jumped as much as 2.5% on Wednesday. Furthermore, Samsung reported that its fourth-quarter profit more than tripled to a record high, thanks to AI’s impact on the memory market.

🎥 ICE Minneapolis Shooting & Trump Demands More Defense Spending | Daybreak Europe 1/8/2026 (Bloomberg)

In the latest episode of Bloomberg’s Daybreak Europe, the program tackled several key financial themes with significant implications. President Trump’s demand for a more than 50% increase in the U.S. military budget to $1.5 trillion, along with his threat to defense companies over shareholder payouts, underscores the administration’s focus on bolstering national defense. Meanwhile, the Trump administration’s plan to control future sales of Venezuelan oil and hold the proceeds in U.S. accounts signals a continued effort to exert financial pressure on the Maduro regime. Additionally, the protests in Minneapolis following the shooting of a woman by an Immigration and Customs Enforcement officer have deepened the ongoing divisions in the country, with the mayor calling on ICE to leave the city. These developments, combined with updates on the global markets and insights from industry experts, provide a comprehensive overview of the financial landscape.

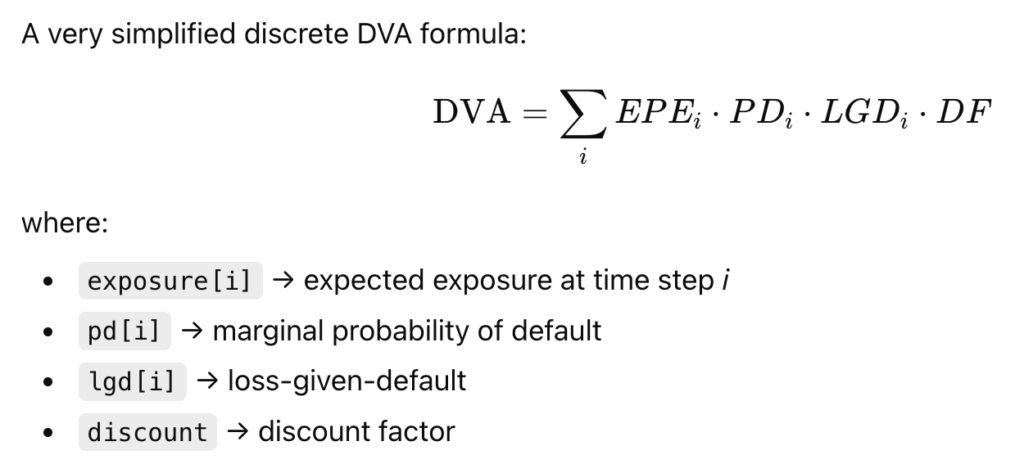

🎥 Fun Quant Interview Question #quantinterviews (Quant Prof)

In this strategic memo, we present a concise analysis of a video that addresses a common quantitative interview question. The video offers a thought-provoking challenge, providing decision-makers with valuable insights into the problem-solving abilities of potential candidates. The content is presented in a formal, succinct manner, highlighting the key elements that would be of interest to finance professionals evaluating prospective hires. This video serves as a useful tool in the assessment of quantitative skills, enabling informed decision-making in the recruitment process. By addressing this type of interview question, organizations can better identify candidates with the analytical acumen required to succeed in the dynamic finance industry.

♟️ Interested in More?

- Read the latest financial news: c++ for quants news.